[ad_1]

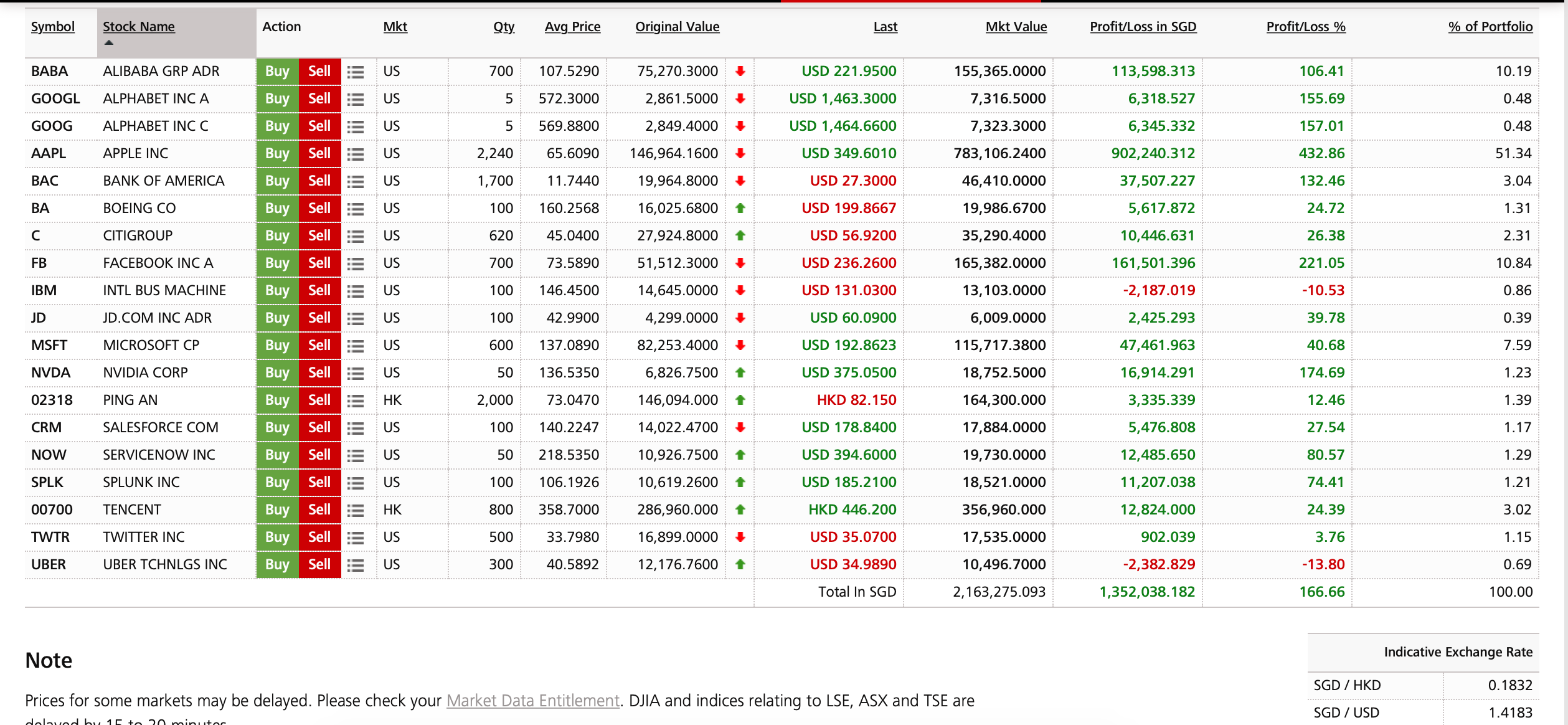

In brief, we did higher than in 2019 however missed our deliberate monetary targets which had been set right here.

It was difficult all 12 months round, Covid-19 restrictions, working from residence, shopping for a home, seeing corporations reducing or suspending their dividends in our portfolio.

All corporations set targets and managers monitor their execution. It’s proved that having a plan lets you get nearer to these targets. We set our monetary targets they usually assist us to remain on the course and enhance understanding and planning of our monetary scenario.

There’s a new unknown monetary setting through which many governments are giving cash away to assist economies. I have no idea what penalties we’ll face due to this free cash pumped into the economies. Most certainly the shopping for energy of cash will deaccelerate much more with inflation and holding different belongings like collaborating in good companies, actual property, and different investments can be most well-liked over holding money.

Due to this fact we’ll keep on our path to monetary freedom and proceed growing our earnings from our passive earnings streams. Let’s see how our monetary targets of 2020 served us this 12 months regardless of the pandemic.

Dividends

We acquired $12,596 in dividends. Two corporations suspended their dividends and 4 corporations diminished their dividends in our portfolio. We deliberate on receiving $13,000 in dividends, and this $404 miss doesn’t look like failure this 12 months.

Actual property

Earnings from actual property was $14,882. After verifying the set objective for this earnings stream I’ve discovered that originally I didn’t calculate properties upkeep value within the final 12 months. The deliberate quantity was $25,000 which ought to be offset by $11,000 due to upkeep value. Upkeep consists of two rental properties taxes, strata and administration charges. Please, notice that this quantity doesn’t embrace the mortgage principal that was paid off throughout this era.

Lending Loop

Earnings from Lending loop totaled $2,553 as anticipated. It was noticeable that small companies have been affected by the pandemic this 12 months on this platform. A lot much less companies had been in search of finance.

Cheque from Google!

For the primary time, I acquired cheque of $104 from Google this 12 months. This earnings stream is passive provided that you’ll chronology your actions in any case. In any other case it isn’t a passive earnings stream and to make it one way or the other a major earnings supply it’s important to make investments time and analysis on the matter.

Realtor reimbursement

I’m not certain if it could be thought-about as passive earnings, however the realtor we labored with to purchase our residence paid us again half of his cost. We have now obtained $6,965. This cash invested for 4 p.c will generate passive earnings of $278 yearly. It’s one thing to think about if you’re seeking to purchase actual property and know what and the place you will purchase.

Getting skilled

Right here is the graph of our monetary targets deliberate and our outcomes for the final 5 years. In 2016 and 2017 we counted capital achieve as earnings and stopped doing that ranging from 2018. The final three years exhibits that we’re getting extra skilled in setting and reaching our targets.

Aah, our passive earnings streams introduced us $30,031. That’s superb! It’s $2,502 in passive earnings each month regardless of the uncertainty out there. It’s already sufficient to stay in some creating international locations without having to go to work however we need to retire within the lovely Vancouver and subsequently we’ve to push our monetary targets even increased and higher.

[ad_2]

how-our-financial-goals-2020-materialized