[ad_1]

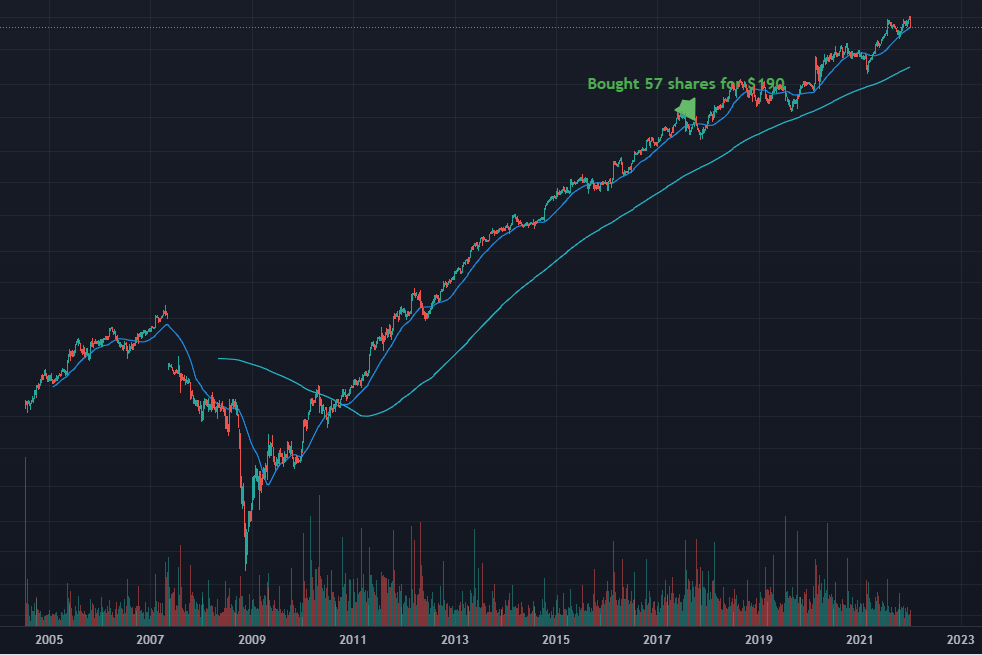

What can assist us to enhance our funding technique? Little doubt, it will likely be studying from our personal greatest investments. In our case it was an funding in Domino’s Pizza Inc (DPZ). I bought 57 shares of Domino’s Pizza for $190 every again in October 2017.

So we maintain this funding for 4 years and three months. Our unrealized revenue from this funding is 267%. Not unhealthy for 4 years return. To make the deal even sweeter we obtained $712 in dividends. We will simply promote our preliminary funding of $10,830 making this funding lossless. The arrow factors to our buy cut-off date on the graph.

How did it begin?

There was a Domino’s Pizza retailer near our townhouse and we have been occasional clients of that retailer. Typically we picked up or immediately ordered pizza with youngsters. On one such event I requested my older son what he thinks about investing in Domino’s Pizza. I all the time attempt to talk about funding concepts with our children. My son instructed me that there are different pizza shops round and possibly the pizza itself is just not the perfect however we do get the perfect deal contemplating the worth and the standard of pizza. Then I checked income of the corporate and EPS, each have been growing so a call was made and we purchased 57 shares. How I’m proud right now, speaking to my youngsters, reminding and exhibiting them this funding.

What we did after shopping for the shares?

Completely nothing. I’ve a buddy on the poker desk, once we requested what he had when he received a hand with out exhibiting the playing cards, he all the time replied “Completely nothing”.

It’s good, doing nothing, possibly solely watching how your funding grows.

We will see that the worth went down by about 15% in about six weeks after the acquisition. Did we fear about that? No, if nothing has modified within the underlying enterprise we knew that the market is perhaps irrational for a very long time. It paid out to do nothing.

Nearer have a look at the asset previous to our buy

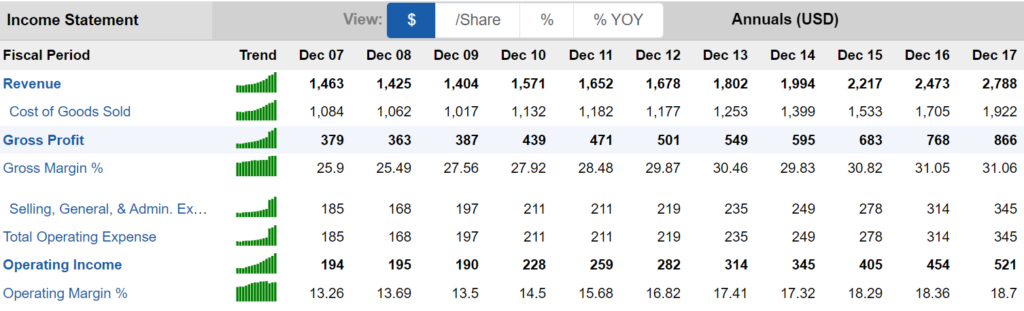

Income in hundreds of thousands went from $1,463 in 2007 to $2,788 in 2017.

Working margin improved from 13.26% to 18.7% on the identical interval of that decade.

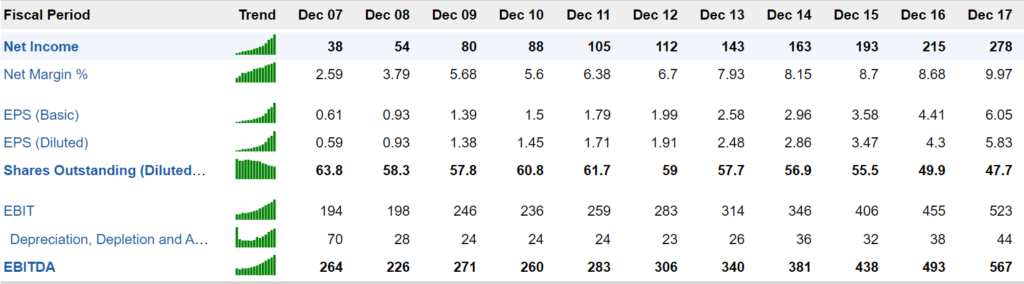

Web Earnings in hundreds of thousands elevated from 38 in 2007 to 278 in 2017.

Earnings per share (EPS) elevated from $0.61 in 2007 to $6.05 in 2017.

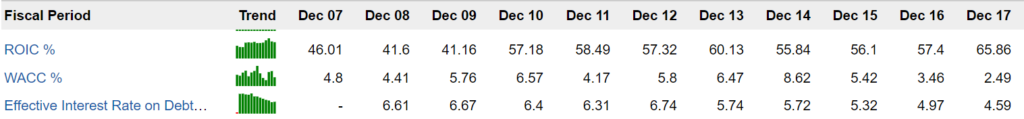

Return on invested capital (ROIC) was additionally spectacular

I appreciated it then again in 2017 once I was taking a look at these numbers and I like them now as properly. I’m going to set these as search standards for the brand new shares I’m going to purchase.

We purchased the shares when PE ratio was 32 and PS ratio was 3.23.

The shares have been in uptrend ranging from the top of 2008. There have been little pull ups within the value simply giving the traders alternative to load extra shares.

Present DPZ valuation

It’s straightforward to see that the development is up, the worth is above 200 shifting common on a regular basis.

The Ahead PE ration is 32.79 and it was about the identical ratio at our buy time.

The three-12 months Dividend Development price is nineteen.2%. These are massive hikes and we love them.

Analysts estimates are constructive, income, EPS and dividends heading north.

How can we enhance funding technique based mostly on evaluation of our high winner?

Income didn’t improve from 12 months to 12 months, there have been years with barely declined income, however income virtually doubled inside 10 years timeframe. So for the search standards I will probably be utilizing median 10-y income development price of about 10%.

Earnings per share (EPS) grew up from 12 months to 12 months. I’ll set EPS development price of 10% for the final 10 years within the screening.

I’m throwing one other parameter into the search 10-y median ROIC (return on invested capital) to be above 25%.

Market capitalization higher than $1.0B to exclude corporations with small capitalization.

So the ultimate gurufocus.com screener is as follows:

- Market capitalization above 1.0B

- Income 10-y median development of 10%

- EPS development price of 10% for the final 10 years

- ROIC is increased than 25%

28 corporations confirmed up operating this screener in gurufocus.com

A few of the corporations on this listing are value consideration to and probably analysis them so we are able to embody them in our funding portfolio.

[ad_2]

how-to-improve-investment-strategy